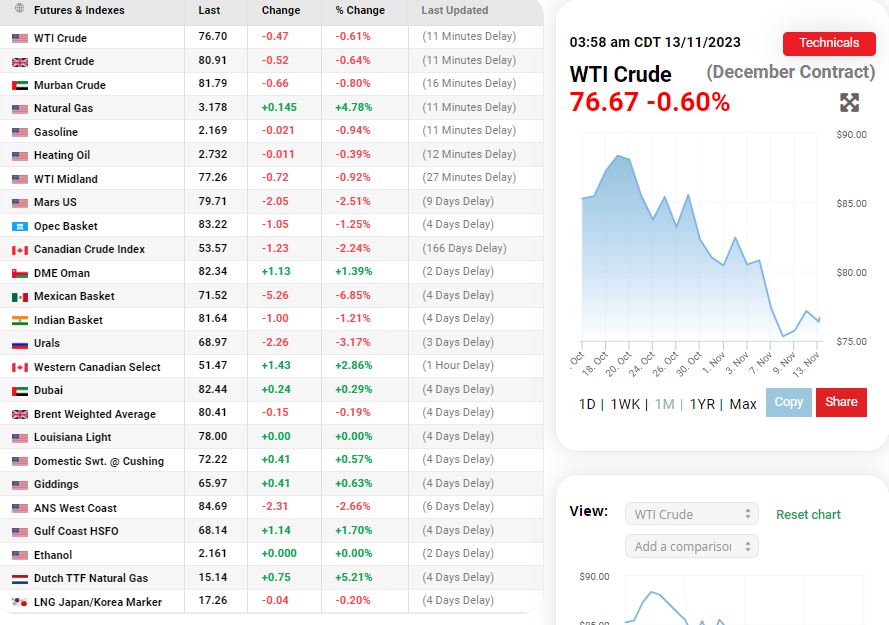

Prices of crude oil began the new week with a loss earlier today, with a renewed focus on demand in China and the United States weighing on benchmarks.

The oil prices chart on OilPrice.com shows that in mid-morning Asian trade, both Brent and West Texas Intermediate had shed close to 1% following news that gasoline demand in the U.S. might fall to the lowest in two decades next year and that Chinese refiners had asked for lower volumes of Saudi crude for December.

Demand concerns continued to weigh on the prices at the start of this week, with WTI falling to $76.47 and Brent trading at $80.75.

While the forecast about U.S. gasoline demand might indeed be conducive to a more bearish behavior among traders, the reason Chinese refiners have asked for lower volumes of Saudi oil does not necessarily indicate lower demand for fuels. What it certainly does indicate is that refiners have run out of fuel export quotas.

Some fresh economic data out of China also contributed to the bearish sentiment among oil traders. Consumer prices for October booked a decline, suggesting lower demand in the country, and reinforcing concern about the economy growing more slowly and unevenly than expected.

Fears of a supply disruption in the Middle East, meanwhile, have largely dissipated, even after Iran warned last week that an escalation in the conflict between Israel and Hamas was inevitable.

“Due to the expansion of the intensity of the war against Gaza’s civilian residents, expansion of the scope of the war has become inevitable,” Iranian media quoted Iran’s Foreign Minister Hossein Amir-Abdollahian as telling his Qatari counterpart Sheikh Mohammed Bin Abdulrahman Al Thani in a telephone conversation on Thursday.

“Investors are more focused on slow demand in the United States and China while worries over the potential supply disruptions from the Israel-Hamas conflict have somewhat receded,” a senior Nissan Securities analyst told Reuters.

“We believe that the scale of the sell-off in oil is exaggerated given that fundamentals are still tight at least in the short term,” ING analysts Warren Patterson and Ewa Manthey wrote in a note on Friday. “However, fundamentals are not as bullish as originally anticipated with Russian oil exports edging higher, whilst refinery margins have also been weakening.”