China’s state-owned China National Offshore Oil Corporation (CNOOC) is poised to explore investment prospects in oil exploration in Angola. This move aligns with Angola’s ambitious target to escalate production to 1.18 million barrels per day (bpd), amidst growing interest from China in supporting strategic investments in the Southern African nation.

The forthcoming Angola Oil & Gas (AOG) 2024 conference, slated to occur in Luanda from October 2-4, is set to serve as a pivotal platform for fostering future collaborations. With a strong international focus, the event is designed to bring global partners together to discuss opportunities spanning the entire oil and gas value chain. Chinese public and private sector entities stand to benefit significantly from engaging with Angola’s latest oil and gas developments at this year’s AOG conference.

Angola, being one of the largest crude oil producers in sub-Saharan Africa, has historically been a crucial oil supplier to China. Although exports experienced a 30% decline between 2020 and 2022, attributed mainly to reduced output in Angola and increased imports from Russia, China has expressed keen interest in reinforcing investment in Angola’s exploration and production landscape.

Angola’s 26.13MW Photovoltaic Plant in Saurimo Nears Operational Status

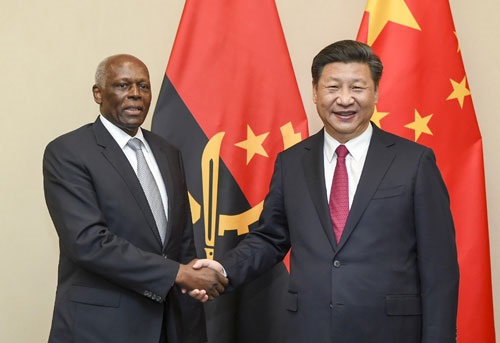

A state visit by Angolan President João Lourenço to Beijing in March 2024 underscored the potential for enhanced collaboration between the two countries in the energy and infrastructure sectors. During the visit, Chinese President Xi Jinping pledged support for Chinese companies investing in Angola, emphasizing a willingness to collaborate on key infrastructure projects. Concurrently, CNOOC is gearing up for discussions regarding Angola’s Block 24, a deepwater concession showcased in the country’s latest 12-block tender, highlighting additional opportunities for collaboration in the upstream industry.

Angola already represents the second-largest destination for Chinese foreign investment, with recent developments in its oil and gas sector poised to further bolster bilateral cooperation. Over the past decade, Chinese firms have invested nearly $14 billion in Angola, primarily in the energy sector. Notable initiatives include an MOU signed between China National Chemical Engineering and Angola’s national oil company Sonangol for the construction of the Lobito Refinery, scheduled to commence operations in 2026.

China’s strategic investment in Angolan exploration not only enhances its own energy security but also stimulates infrastructure development throughout the value chain in Angola. With China relying on imports to fulfil 72% of its oil needs, investing in Angolan exploration presents a strategic opportunity to diversify its energy sources. For Angola, Chinese investment is pivotal in meeting production targets and revitalizing infrastructure development in both onshore and offshore exploration ventures.

Against the backdrop of Angola’s declining oil production since its peak in 2010, AOG 2024 in Luanda, themed “Driving Exploration and Development Towards Increased Production in Angola,” presents an opportune moment for China to deepen ties with Angola across the oil and gas industry.